Picture this: You’ve just pulled an all-nighter finishing a massive project for a new client. You’re exhausted, but also excited. The hard work is done. Now comes the best part—getting paid.

You sit down at your laptop, open your email, and... freeze.

Your client’s accounting department just emailed you asking for a "PO Number" before they can process your "Invoice," and they also want a "Receipt" for the deposit you haven't even received yet.

Panic sets in. "Did I forget something? What is a PO? Am I going to get paid?"

Relax. Take a breath. We’ve all been there.

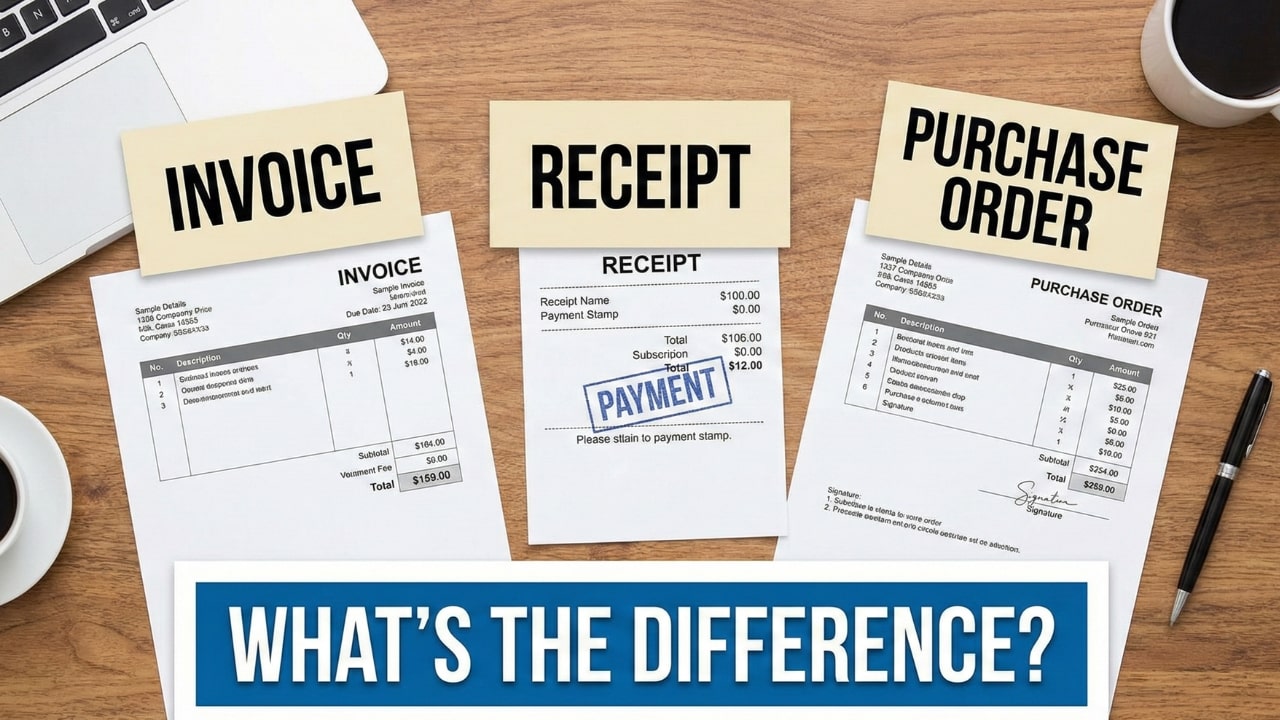

Mixing up billing documents is practically a rite of passage for every freelancer and small business owner. But here’s the truth: understanding the difference between an Invoice, a Receipt, and a Purchase Order (PO) isn't just boring paperwork—it’s the secret to looking professional and ensuring money lands in your bank account on time, every time.

In this guide, we’re going to cut through the jargon and explain exactly what each document does, when to send it, and how to create one in seconds using our Free Invoice Generator.

1. The Purchase Order (PO): The "Permission Slip"

Timing: Before you lift a finger.

Let’s start with the one that trips people up the most: the Purchase Order, or PO.

Think of a PO as a formal "wish list" or a "permission slip" sent by the Client (Buyer) to You (Seller). It’s their way of saying, "Yes, we officially authorize you to do this work for this specific price."

Why should you care?

Imagine you spend weeks building a website based on a phone conversation. You send the bill, and the client says, "Oh, we never actually approved that budget." Nightmare, right?

A PO protects you from that nightmare. It is a binding contract. If a client sends you a PO for "Web Design - $2,000," they are legally promising to pay you that amount once the work is done.

⚠️ Freelancer Warning:

Many large corporations have a strict "No PO, No Pay" policy. If you start working without a PO number, their automated system literally cannot pay you. Always ask: "Do you need to issue a PO before I start?"

Key Characteristics of a PO:

- Sent BY: The Client (Buyer).

- Sent TO: You (The Freelancer/Business).

- Main Goal: To order goods or authorize services before money changes hands.

- What’s on it: A unique PO Number, list of items/services, and the agreed price.

2. The Invoice: The "Professional Demand"

Timing: After the work is done (or when requesting a deposit).

This is the main event. The star of the show. The document that keeps your lights on.

An Invoice is a formal request for payment sent by You to the Client. It basically says: "Remember that work listed on your PO? I finished it. Now, please pay me $X by this date."

Unlike a casual text message saying "Hey, can you Venmo me?", a professional invoice carries legal weight. It is the primary document used for tax reporting, accounting, and inventory tracking.

Pro Tip: Never send a Word document or an editable Excel sheet as an invoice. It looks amateur and allows people to accidentally change the numbers. Always send a locked PDF. You can generate a sleek, professional PDF in seconds using our Free Invoice Tool.

Key Characteristics of an Invoice:

- Sent BY: You (The Seller).

- Sent TO: The Client (Buyer).

- Main Goal: To track the sale and demand payment.

- Must Have: The word "INVOICE" clearly visible, a unique Invoice Number (e.g., INV-001), your contact info, the client's info, payment terms (like "Due in 30 Days"), and banking details.

3. The Receipt: The "Proof of Payment"

Timing: Only AFTER the money is in your hand.

A Receipt is the final handshake. It is a document that proves the transaction is complete and the debt is settled.

Many freelancers skip this step, but that’s a mistake. Your clients—especially business clients—need receipts to prove to the tax man that they actually spent the money they claimed as an expense.

If a client pays you via an automated platform (like Stripe, PayPal, or Uber), the system generates a receipt automatically. But if they pay you via Bank Transfer, Check, or Cash, it is your responsibility to send them a receipt marked "PAID."

Key Characteristics of a Receipt:

- Sent BY: You (The Seller).

- Sent TO: The Client (Buyer).

- Main Goal: Proof of ownership and payment.

- Must Have: The date of payment, the amount paid, and the payment method used (e.g., "Paid via Visa ending in 1234").

Scenario: The "Cookie Shop" Analogy

Still feeling a bit foggy? Let’s strip away the business jargon and imagine you run a custom cookie shop. Here is how the three documents work in real life:

Step 1: The PO (The Order)

A customer walks in and hands you a piece of paper. It says: "I want to order 100 Chocolate Chip Cookies for a party next Friday. I agree to pay $2.00 per cookie."

That piece of paper is the Purchase Order.

Step 2: The Invoice (The Bill)

You bake the cookies and pack them in a box. You tape a paper to the box that says: "Here are the 100 cookies you ordered. You owe me $200. Please pay by Friday."

That paper is the Invoice.

Step 3: The Receipt (The Proof)

The customer hands you $200 cash. You give them a small slip of paper that says: "Received $200 cash for 100 cookies. Date: Today."

That slip is the Receipt.

The "Danger Zone": What Happens If You Mix Them Up?

Using these terms interchangeably isn't just a grammar mistake—it causes real business headaches.

- If you send a Receipt instead of an Invoice: The client's accountant will see "Receipt" and assume the bill has already been paid. They won't cut you a check. You’ll be waiting by the mailbox forever.

- If you forget the PO Number on your Invoice: If you are working with a big company, their automated system will reject your invoice immediately. It might sit in a "rejected" folder for weeks without you knowing, delaying your paycheck.

- If you don't send a Receipt: Your client might panic during tax season because they can't prove they paid you, leading to frantic emails months later asking for paperwork.

Summary Table: Your Quick Cheat Sheet

| Document | Who Sends It? | When? | The "Vibe" |

|---|---|---|---|

| Purchase Order (PO) | Client | Start of project | "I promise to pay you" |

| Invoice | You | End of project | "Pay me now, please" |

| Receipt | You | After payment | "We are all good" |

Final Thoughts: Keep It Simple

Billing shouldn't be the hardest part of your job. By knowing exactly which document to send and when, you signal to your clients that you are a professional who deserves to be taken seriously (and paid promptly).

Don't let paperwork slow you down. If you need to send an invoice right now, don't struggle with Excel templates that break every time you add a row.

Need to create an Invoice?

Our free tool handles the formatting for you. No sign-up required.

Generate Invoice Now